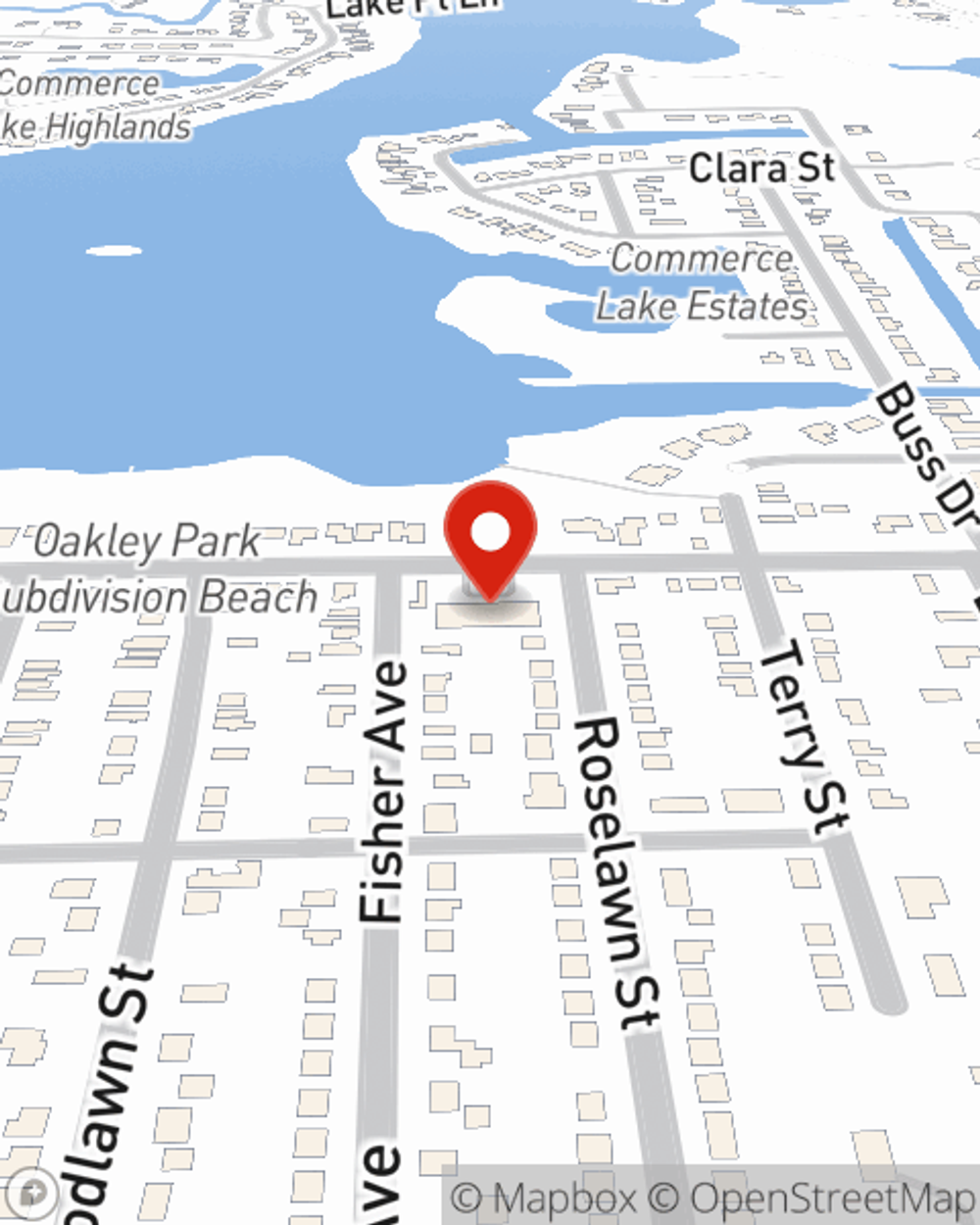

Business Insurance in and around Commerce Twp

Researching coverage for your business? Search no further than State Farm agent Jason Doyle!

This small business insurance is not risky

Your Search For Great Small Business Insurance Ends Now.

Preparation is key for when something unavoidable happens on your business's property like an employee getting injured.

Researching coverage for your business? Search no further than State Farm agent Jason Doyle!

This small business insurance is not risky

Get Down To Business With State Farm

With options like extra liability, business continuity plans, worker's compensation for your employees, and more, having quality insurance can help you and your small business be prepared. State Farm agent Jason Doyle is here to help you customize your policy and can assist you in submitting a claim when the unexpected does happen.

Take the next step of preparation and contact State Farm agent Jason Doyle's team. They're happy to help you discover the options that may be right for you and your small business!

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Jason Doyle

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.